Interest only mortgage calculator with additional payments

Mortgage Loan Interest Rates 2022 Check Eligibility Mortgage Calculator BEST Features Benefits from TOP Banks Documents required Apply Now. Low if your lender allows interest-only payments during the draw period as many do.

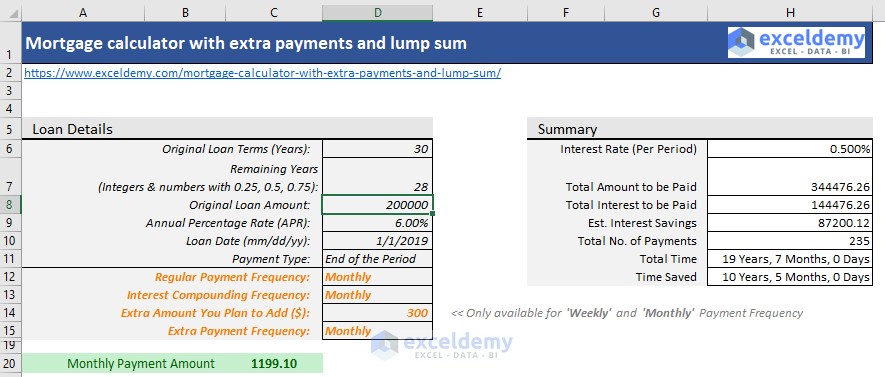

Extra Payment Mortgage Calculator For Excel

Though the interest rate typically drops only a fraction of a percentage per point this difference can be felt in each monthly payment as well as the total amount you eventually pay.

. Any delays in interest or EMI payments will attract an additional interest of up to 24 pa. Building a Safety Buffer by Making Extra Payments. Unless you increase your credit score you may not be eligible for a shorter term with a lower rate.

Its a loan secured against your home. If you wish to see what effect changing any of the basic values would have varying the loan amount interest rate length etc. Thus most homeowners should plan to adjust the budget as the loan matures.

Because interest payments on your primary residence are tax-deductible for loans up to 750000 100 percent of your interest-only mortgage is tax-deductible if you itemize. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially granted. Make more frequent payments.

The calculator will take all this into account and will calculate your bi-weekly payment amount your total interest savings and how much faster you will pay off your auto loan. N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage. For ARMs interest rates are generally fixed for a.

P Principal Amount initial loan balance i Interest Rate. Mortgage calculators can help you to include these additional factors when youre determining the necessary monthly payments for your new home. 30-Year Fixed-Rate Mortgage Loan Amount.

Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. The earlier you. Second mortgage types Lump sum.

The final word Ultimately mortgage calculators ensure that borrowers are more informed when it comes to the financial side of purchasing a home and enable home buyers to make the choices that are. Additional loan options are listed in the drop down filter area. Second mortgages come in two main forms home equity loans and home equity lines of credit.

The Math Behind Our Mortgage Calculator. 15-Year Vs 30-Year Mortgage Calculator. To borrow any additional money from your HELOC before that.

You pay the interest each month which means the amount you owe doesnt increase over time. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

Mortgage loan basics Basic concepts and legal regulation. Total of 360 Mortgage Payments. Retirement Interest Only Mortgage Monthly payments Please add 0 for any that you dont have.

Additional Mortgage Payments Can Work for You. 51 interest-only ARM--The monthly payment stays at 960 for 5 years but increases to 1204 in year 6. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage.

Mortgage rates valid as of 31 Aug 2022 0919 am. Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan. Additional calculations and evidence will be required to fully assess how much you can afford to pay.

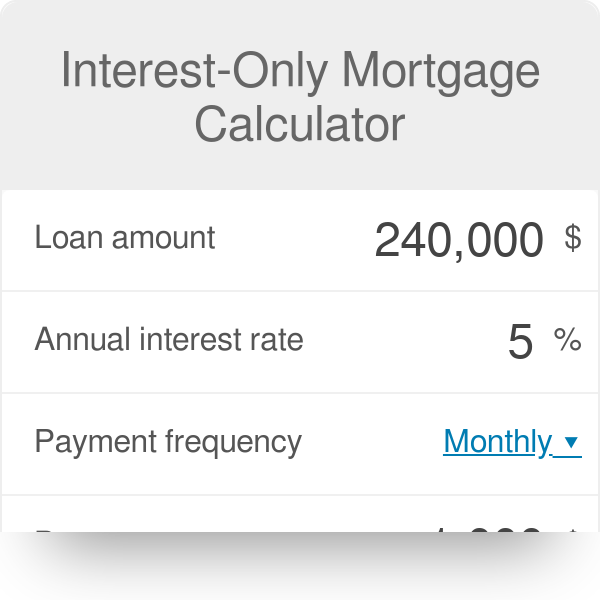

They include - floating rates fixed interest rates interest-only mortgage and Payment option. Paying an Interest-Only Mortgage. Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise.

The calculator above calculates fixed rates only. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term.

Use our mortgage calculator to estimate the cost of different loan types and compare interest paid for a 15-year mortgage and a 30-year mortgage. You can adjust those using the. The payment rises because interest rates are rising and because.

Fixed-rate 5-year interest-only mortgage--The monthly payment stays at 1035 for the first 5 years and then increases to 1261 in year 6 as you begin to pay down the principal. A borrower also benefits from purchasing discount points by lowering their applied interest rate over time. Its understandable why buyers are drawn to more affordable monthly payments.

Whatever the frequency your future self will thank you. For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations. While analyzing the various methods of making extra mortgage payments consumers should consider their individual financial status.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. With our Retirement Interest Only Mortgage calculator you can find out how much you could be eligible to borrow in just a few minutes. Todays national mortgage rate trends.

In the example above after one year of additional payments the principal amount would increase to 13700. A 30-year fixed-rate mortgage is the traditional loan choice for most homebuyers. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Additional factors to consider when calculating student loan interest. This tool helps buyers calculate current interest-only payments but most interest-only loans are adjustable rate mortgages.

If you have less-than-pristine credit a 30-year fixed loan may be the only mortgage option for you. M Monthly Payment. The Retirement Interest Only Mortgage sometimes called a RIO Mortgage is available to people over 55.

When calculating your student loan interest keep in mind that there are a few other key factors at play. For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Mortgage Payoff Calculator With Extra Payment Free Excel Template

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Payoff Calculator With Line Of Credit

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Interest Only Mortgage Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Interest Only Mortgage Calculator With Additional Payments

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Loan Repayment Calculator

Free Interest Only Loan Calculator For Excel

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com